Business Finance That Moves Your Company Forward

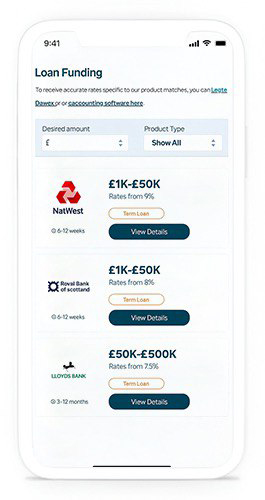

Kredzo Fund helps UK businesses access smart, flexible funding — fast approvals, personalized guidance, and support you can count on.

Smarter Finance.

Stronger Future